Note: this is a long guide that will take some time to read and fully digest. If you’d rather just grab a PDF of this post and all the bonuses and read later at your leisure, just grab the free VIP pack, which contains a PDF of the full guide.

“In the midst of winter, I found there was, within me, an invincible summer.” — Albert Camus

Could you survive a major economic downturn?

What if your freelance earnings took a 50% hit for six months? Would you be able to weather that storm?

What if you lost most of your income for two years?

In this guide, I’m going to tell you why you need to consider the effect of a serious economic downturn RIGHT NOW (including one that might be just around the corner), and exactly what you can do to make your freelance career recession-proof.

This article isn’t about being negative or fearful.

It’s about being prepared.

It’s about victory.

I’m incredibly optimistic about the future of the US and global economies, about freelancing as a career path, and about your ability to build an amazing life as a freelancer.

Yes, you. Especially you.

But it does no good to be an ostrich and stick your head in the sand, ignoring the discussion of anything negative. Ignoring bad things doesn’t make them go away. It makes them sneak up on you without warning.

So let’s talk about why you will experience a bad downturn at some point, and exactly how to make your freelance career recession-proof.

Note: If you’re already in a downturn of some kind, then the free VIP pack for this guide has an awesome resource for you, my guide on filling up your pipeline in an emergency. It’s chock full of the kind of advice that you should have taken a while ago, but better late than never, right? Grab the free VIP pack right now.

Freelancing in a recession: a personal story

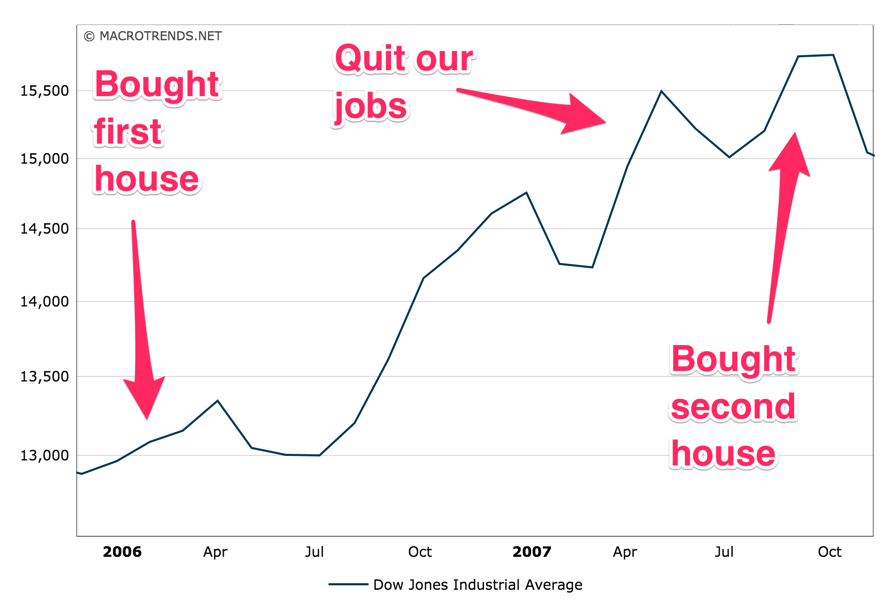

In the summer of 2007, I was living in San Francisco, working as a product manager at CNET, and generally having a grand time.

I started doing freelance web development on the side, and within a few weeks, I was making enough to feel comfortable quitting my job. My wife quit her job to freelance the week after I did.

And why not? We were making plenty of money freelancing, there was tons of work, and we could easily get jobs again if we needed to.

The economy was roaring, especially the housing market. We had just bought a rental property (my 2nd) at the beginning of 2007. In August of 2007, around the same time we quit our jobs, we bought another one. All the properties were in Colorado, because even back then we couldn’t afford San Francisco real estate. Now only heads of state can.

So we were rocking along, hustling for clients, trying to work out of our studio apartment. Yeah, the money was a little tight. Yeah, we had some debt. Sure, living in San Francisco was expensive, and we were dealing with irregular income and all the expenses and hassles of three investment properties.

But really, with this kind of economy, what could go wrong?

I started taking flying lessons.

We spent three months traveling Asia.

We got two dogs.

And we slowly started racking up debt. Just a bit here and there. I knew it was a bad idea in theory, but I wasn’t really worried. We could make so much freelancing, what was the problem?

If you know anything about freelancing, personal finance, stock market history, or just general common sense, all kinds of alarm bells should be going off for you right about now.

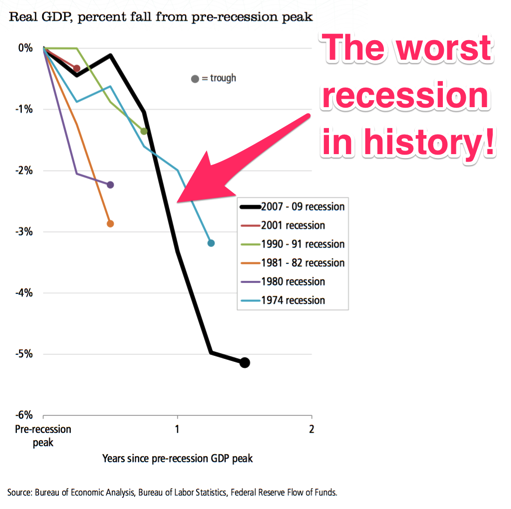

Halfway through 2008, this happened:

Even though the 2008 crisis was the worst recession in history, it didn’t feel like it – at first.

For us as freelancers on the ground, it wasn’t like a movie where things took a dramatic downturn. Clients didn’t immediately stop returning our emails, everyone kept paying what they owed, and clients were even still hiring us.

But throughout 2008, it started to get increasingly difficult to get new clients, and to keep the clients we had.

By 2009, the debt load started to really become a problem. We had had some cushion when we quit our jobs, but that had mostly evaporated by now. The three rental properties were not profitable, so we had to feed them a little every month.

As we grew increasingly stressed and desperate, things got even worse. Clients don’t like to hire desperate freelancers, so desperation can quickly become a downward spiral.

2009 in particular left a scar on my soul.

I wasn’t able to focus while working from home, so I rented a little office in a terrible building that was literally scheduled to be torn down. It was a terrible, depressing place.

I pretty much worked all the time. We were right on the edge in terms of our personal finances. For a period of several months in 2009, our rent check would overdraft every month, until I could get a client to pay me enough to pay off the overdraft debt. We were stuck in a bad loop, and I didn’t know how to get out of it.

I will always remember walking home from that shitty office, well after dark, night after night, just feeling like the weight of the world was on my shoulders. I felt incredibly trapped. We talked many times about moving away from San Francisco, but there was a huge cost to that as well, both in terms of the money to actually move, and for the hit that I thought my freelance income might take as a result.

Now, looking back, I can really only blame part of our struggles those first few years on the market crash. To be honest, we just did a bunch of really stupid things, like poorly manage our personal finances. We also had no idea how to run successful freelance businesses, which made our income sporadic and too low, compounding the personal finances problems.

However, the overall economy did play a role in our issues. I’ll walk you through what I learned from the experience, and how you can prepare for your own downturn.

And trust me, you will face a downturn. It’s not a question of if, just a matter of when.

I want to make two really important points:

First, the best time to deal with a recession is well in advance of one. I felt trapped because I was trapped. It’s very difficult to prepare for a recession when your back is up against the wall. It’s not too late at that point (it’s never too late), but it’s a lot harder.

It is so much easier to make the changes in advance of needing them, when you have margin to do so.

Second, none of the things we should have done to prepare for the market crash were some special recession-proofing tips. They were things we should have been doing anyway.

But why should you care about that?

Isn’t everything great right now?

Let’s talk about that, before I get into practical lessons.

Again, not doom-and-gloom, just some context for what’s going on and why I’m writing this now.

The next two years may be interesting

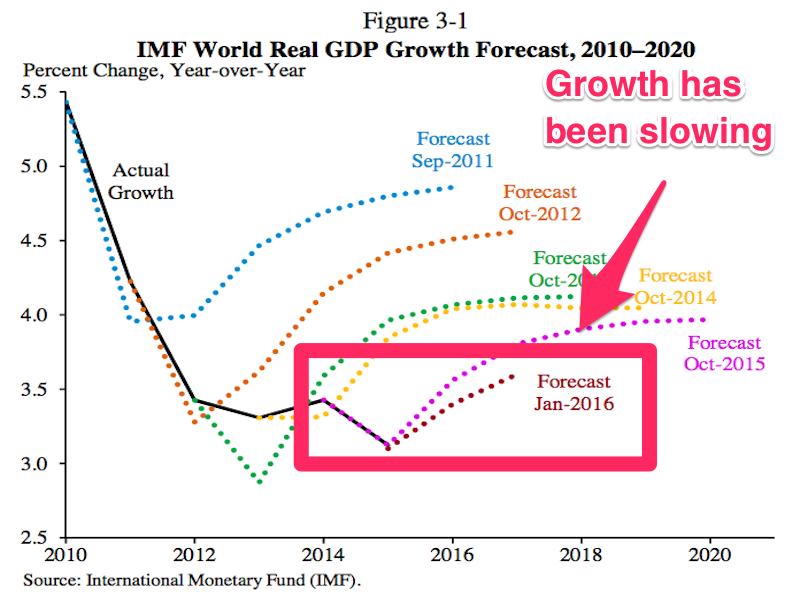

This isn’t a post about macro-economics, which is good, because I’m not an economist. But some smart people are starting to talk, and I’m a little concerned.

After a great run since the crash in 2008 and 2009, the economy may be starting to stumble again.

It’s not all bad, but there are some negative indicators. The tech industry in particular seems to be going through some shakeups. Unicorns are starting to stumble, tech stocks are getting hammered.

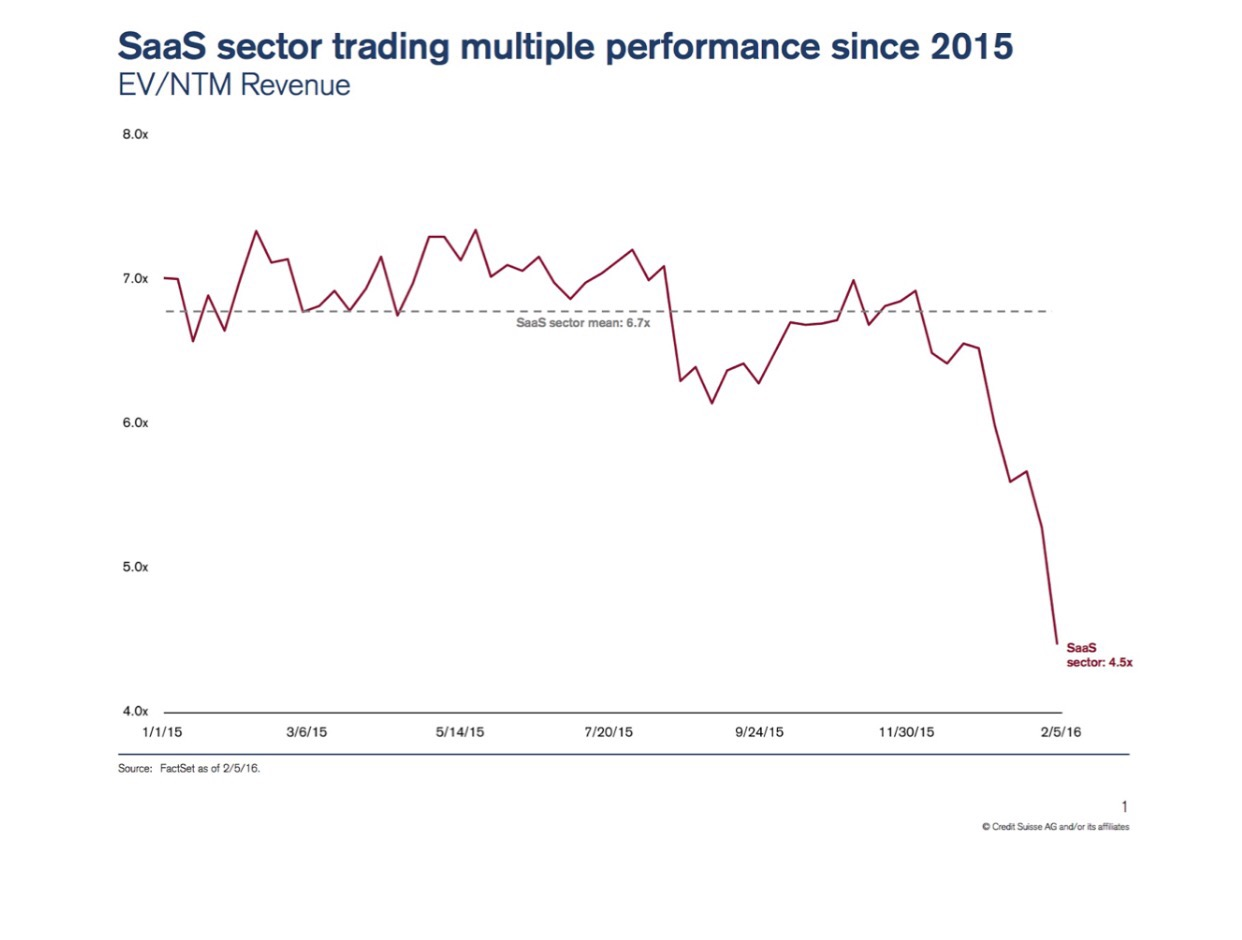

(The SaaS sector has already taken a big hit)

When VCs start talking about how startups need to focus on profitability and cashflow, you know that things are starting to turn.

You might not work in startups, or maybe you don’t work in tech at all. None of this will affect you, right?

Right, just like housing prices didn’t affect the rest of the economy back in 2007. Whoops.

Sorry, but even if you don’t work in the startup world, you might be affected by all of this more than you think.

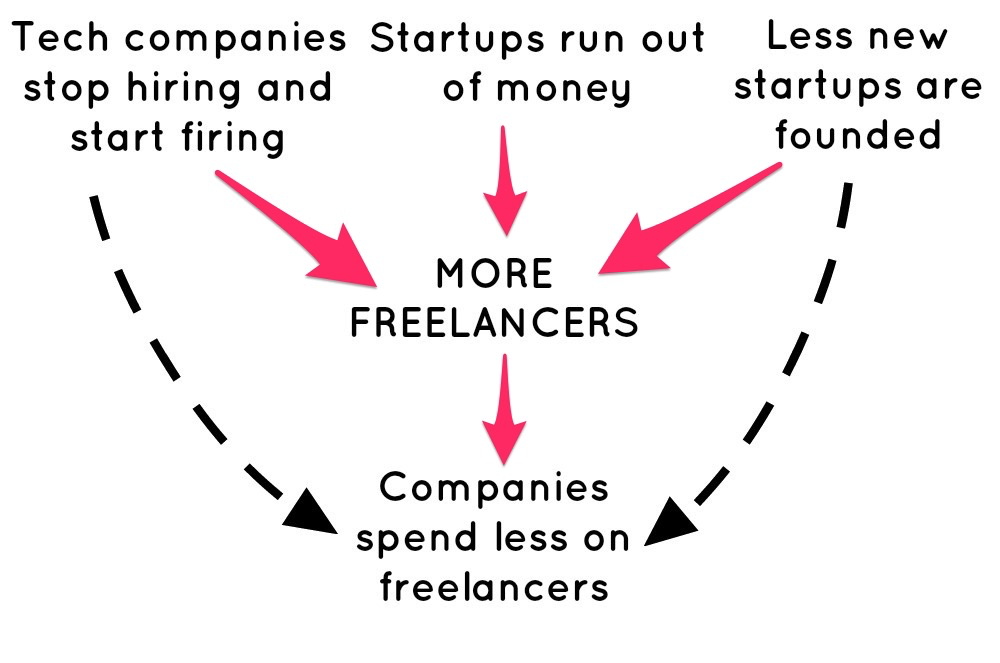

When startups and tech take a hit, you might become a victim of the domino effect, which feeds upon itself to put more and more freelancers into the economy to compete against you for clients and gigs.

Let me explain.

First, big tech companies slow their hiring, and do some layoffs. That means the people laid off and the people not getting hired are both potentially freelancing.

Second, hundreds or thousands of small startups run out of cash, and unable to raise more, just fold up shop and disappear. Their founders and employees are now potential freelancers.

Third, thousands of small startups never get off the ground at all. Freelancers who would have stopped to start their own startup just keep freelancing.

And on top of all of this, there’s an overall economic slowdown, so companies that hire freelancers are spending less, and they’re pushing hard for the best deal they can get.

This leads to a situation where the same factors that create more freelancers also make it harder for freelancers to thrive.

So there’s a lot of pressure on both the supply and demand side of the equation, and you’re/we’re caught in the middle. That drives down freelancer wages.

The economy might be fine

If the last section didn’t sell you, that’s fine. I’m not sold myself. The economy is so huge and complex that it’s hard to know what’s happening right now, let alone in the future.

So maybe there won’t be a recession in 2016 or 2017. Maybe the economy is fine, and the issues I discussed above are just little blips.

Or maybe it doesn’t matter for you personally. Maybe you’ve got a client base that wouldn’t really be affected by a downturn.

However, that’s a lot of maybe’s.

Don’t get me wrong, I really hope all of that is true for you. But even if it is…

You will face a serious downturn at some point

To go back to my own story of freelancing during a downturn, you’ll notice that I didn’t provide an ending.

The good news is that 2010 was a turning point for us. We finally started to figure out some of what we needed to in terms of hustling for clients, closing deals, being more productive, pricing better, getting repeat and referral work, and handling finances better.

I finally crossed into six figures of income in 2010, got a taste of freelance success, and my income has continued to rise. For the last few years, I’ve consistently made at least $250k per year in net profit, and the outlook is very good for the future.

But that’s not the end of the story.

Remember how I said 2009 left a scar on my soul?

About that…

The end of this story is that there is no end of this story. Things are going amazingly well for me right now, but I don’t think that will always be the case.

The market will crash. Or my particular segment of the freelance economy will go through a rapid and drastic shift. Or I’ll experience a major illness or a personal tragedy.

Or all of the above.

I don’t know what’s going to go wrong, but something will, eventually.

That might sound pessimistic, even defeatist, but it’s really not. The truth is that life is long, and bad things happen. The days of me thinking I’m invincible or that nothing bad will happen to me or those that I love is behind me. No more Pollyanna.

And in spite of my near-certainty that there will be valleys and tough times ahead, I’m incredibly excited for the future.

I feel equipped to handle the downturns of life, whether internal or external, personal or global. A big part of that is about relationships, faith, philosophy, and other things well beyond the scope of this article.

But another big part of it is that I’ve learned many lessons from the last nine years of freelance, and I’ve built a strong foundation that will allow my business to thrive in a downturn – yes, thrive.

You see, there’s another side of the coin (like there always is).

Being a freelancer in a recession has upsides.

Why freelancing can be better in economic downturns

There are three big reasons why you’re better off during a recession if you’ve been freelancing for more than a year or two: flexibility, control, and experience.

Note: These apply best to economic downturns, but also to personal situations where you may need extra flexibility and bargaining power.

1. You’re a great alternative to an employee

Believe it or not, you’re much more attractive in some ways as a freelancer, contractor, or consultant, than as a full-time employee.

For one thing, employees are expensive. There’s a saying that overhead walks on two legs. For many businesses, salaries and other compensation is the biggest item in their budget.

And although we don’t live in the era of corporate loyalty anymore, companies generally don’t like to layoff their employees any more than they have to. It’s expensive, bad for their image, and horrible for morale.

So when times are uncertain, companies may be very reticent to take on additional staff. New employees are expensive while they’re around, and employers don’t want to turn around six months later and lay those folks off, if they happen to no longer need them.

But they still need to get work done. Who’s going to do all this work?!

Freelancers!

Freelancers are great in a downturn, because of the clear and mutual understanding that this is a temporary engagement. If the firm only needs your services for three months, there’s no drama when those three months are up. Freelancers let companies scale their staff more dynamically in response to changing conditions within the firm, and in the overall economy.

Sadly, sometimes firms hire freelancers because they’re cheaper than the overall compensation of a similar employee, but that’s not you, right?

If it is, you’re undercharging. Don’t do that.

2. You’re in control

Imagine being a typical employee when the economy goes south. You can see that your firm is struggling.

If you get laid off, then what? The other firms in your industry aren’t hiring, and you’d be competing with a big pool of talent that was also recently laid off.

And in many cases, whether you get laid off is in the hands of a single decision maker, two if you’re lucky.

That’s scary.

Contrast that with a freelancer. If you’re like most freelancers, you have multiple clients, so no one person can wreck your life.

You also have ownership, and you can try all kinds of things to improve the health of your business and grow your income.

If you see a market opportunity to provide a service that you think there’s demand for, you can start doing that tomorrow. You don’t need to run it through the death-by-committee gauntlet and watch it get killed by nervous bureaucrats (you can probably tell how much I love having a job, huh?).

While you shouldn’t try and get through a recession by charging less, you can control your costs more effectively than a firm. And unlike employees, you can often more easily move to another area of the country or the world, if that’s a better fit for your situation.

In short, you can chart a course and then steer the ship that way immediately. Employees are mostly along for the ride.

3. You’re years ahead of new freelancers

If you’ve been freelancing for a while, you have assets you may not have considered.

First, you have a functioning network, or at least you should. You’ve likely worked with multiple clients, other freelancers, and talked to many potential clients. Those relationships can be invaluable, if nurtured.

Second, you’re used to this life. You know what it means to hustle, to get out there and find the work, get it done, get paid for it, and repeat.

It can be easy to forget how much of a shock to the system this mode of living can be, if you’re used to a steady paycheck on autopilot.

Sadly, many of your new competitors will be inexperienced and desperate, and trying to freelance will be overwhelming, stressful, and discouraging. This is a recipe for total failure and a race to the bottom on their part.

Note: If you haven’t been freelancing for a while, or if you haven’t developed the kind of network and hustle habits that you should, it’s even more important that you grab the free VIP pack right now, partly because the info and resources will help you get started on those today, but also because I’m going to write a comprehensive guide to starting a freelance career from scratch, and I don’t want you to miss it!

So yeah, it’s not all bad. If you’ve been freelancing correctly and you’re ready to take action, you’re actually pretty well-positioned to take advantage of the situation.

Let’s talk about exactly what you should be doing to both prepare for a downturn, and to take full advantage of one, if and when it occurs.

Actionable advice to prepare for the winter

If you’ve read this far, I hope you’re convinced that while a downturn may or may not be coming in the near future, you’ll eventually need to weather a storm of some kind, and it’s best to be prepared. So here’s what you can do about it:

1. Warm up your network

One of the most valuable things you can have during a rough patch is a strong network. There are few things more powerful than an active network of friends and colleagues, referring you quality work from good clients.

If you’ve been doing this for awhile, you probably have a network. And if you’re like most freelancers, you probably don’t take great care of that network.

Like a parachute, the time to start preparing a network is well before you need it.

So if you haven’t reached out to a dozen people from your network in the last month, start now.

Just pick up the phone and call! It really works, watch me:

Actually, that’s not really me; that’s Academy Award winning actor Brad Pitt. (Image source)

Just kidding, I don’t call clients. Or anyone really. It’s 2016.

But you have a lot of ways you can connect and add value. I’ll list 10 right now:

- Share some helpful articles

- Ask how another freelancer has been doing

- Send a potential client someone’s way

- Ask for feedback on one of your projects

- Send someone compliments on their project

- Go to meetups

- Give a talk at a conference

- Appear on a podcast

- Host a podcast

- Start using Twitter (or start using Twitter again)

…etc, etc – the list goes on and on.

There are a billion ways that you can build stronger connections with the people you’ll need support from if things turn south.

Oh, and don’t be a taker, just hitting people up for what they can do for you. Everyone hates that.

For more help with networking effectively, read Never Eat Alone and How to Win Friends and Influence People. They may seem hokey, but read them with a genuine heart, an open mind, and a lack of cynicism and they’ll truly help you step up your networking game.

2. Charge more

This one might seem crazy, but one easy way to ensure your freelance success and stand out in a recession is just to charge more than everyone else.

Desperation drives down wages, but it also drives down quality.

During a bad downturn, there are a lot more desperate, inexperienced freelancers at the bottom end of the market, competing for the same jobs.

For good firms, this actually doesn’t represent the opportunity you might think. There are simply too many people at the low end, and weeding through them to find a few underpriced gems often isn’t worth the trouble and the risk.

Charging more sends a powerful signal that even though things are bad in the market, they’re not bad for you.

And good firms will see that as a beacon of quality and professionalism. Instead of sifting through thousands of terrible proposals on Upwork, desperate to design their website for $1000, they’ll just hire you for $10,000 and be done with it.

It might seem unbelievable, but I’ve seen this work for me time and time again.

And that’s not just true for downturns, by the way. Like everything else on this list, you should be doing it all the time.

3. Clean up your personal finances

I talk a lot about freelance as a serious career and as a business. That’s because I think too many freelancers don’t take it very seriously. They mess around with it and don’t treat it like a “real business”. No wonder they get subpar results!

But the truth is that freelance is different from any other kind of business, because while it can and should be very professional, it’s also deeply personal.

One of the ways that this personal / professional dichotomy manifests itself is the effect that your freelancing has on your personal finances, and vice versa.

There are two big things in particular here that I recommend:

- Cut your personal expenses as much as you can

- Build up a buffer of cash to give you options

Ok, this isn’t rocket science, but the fact that it’s simple and obvious doesn’t make it easy.

It took me years to accomplish the two steps above. But my freelance career didn’t really take off until I got a handle on my own personal finances.

First, let’s cut your expenses down if you can. And you almost always can. It’s just a question of whether you will.

So here’s why you should.

Every $100 per month that you can cut in personal expenses is $150 – 200 that you don’t have to try and earn, thanks to taxes and business overhead. And during a downturn, it’s so nice to not need to find that extra client when finding clients can be tough.

Or even better, to be able to fire that nightmare client because you’re not that desperate.

What’s more, firing that client frees up your time and mental energy to be able to go find that amazing client who will be fun to work with, pay well, and pay on time.

You don’t want to be in a situation where you can’t even go find the next great client because you’re so bogged down dealing with the toxic ones, and you can’t fire them because you have to pay the credit card bill, the car payment, the mortgage, etc, etc.

Get rid of as much of that crap as you can. Go minimalist, simple, and clean. It’ll feel like a huge weight has been lifted off your shoulders.

You can then funnel the extra cash into a rainy day fund. You’ll sleep better at night knowing you have something to fall back on.

Now, both of these are pretty obvious, but like I said, that doesn’t make them easy.

What I think isn’t quite as obvious is the emotional and psychological effects of making more than you need to live on, and having a big buffer of cash that you’ve saved up.

It changes everything about the way you view your work, how you interact with clients, and the respect you have for yourself.

John Goodman says it best here: (LANGUAGE WARNING!)

Get yourself in that position.

4. Move your freelance business towards recurring income

A lot of freelancers spend their entire careers moving from project to project, never having a good idea what the next month will look like, let alone the next year.

There’s nothing wrong with that (I make the majority of my income from projects), but it can be stressful, especially if there’s not a lot of difference between your average income and your monthly budget. In a downturn, that stress will only intensify as it becomes harder to land projects.

I want to encourage you to look for ways to build in recurring income sources, also known as retainers.

The main difference with retainers is that we’re shifting the default to continuing to work together each month. The client can always cancel, but they have to actively cancel. With project work, the default is that you’re not doing the work or getting paid.

Now, structuring and landing retainers as a freelancer is a huge topic, and I’m writing a separate guide on it, but here are the basics.

How to best find recurring revenue items will depend on your business, but here are a few different ways that retainers can work:

Block retainers — This is where the client is just pre-purchasing larger blocks of your time, often at a discount. Better than nothing, but not ideal, as you can’t really increase your profit margin with these, and they’re easily cancelled.

Availability / Batphone — This is where the client is paying for you to be available for them, either for actual work, or for questions and advice that they may need. Typically these would have a max (10 hours per month, 5 days per quarter, 1 phone call per week, etc) with no rollover, so they can be great if the client doesn’t use 100% of them. If they always use 100% of the max, then these are just a block retainer.

Maintenance and support retainers — The client has something that needs regular servicing and attention, and they don’t want to mess with it. You take it over and keep everything running smoothly.

The last one is the best one, because it’s typically fairly predictable (unlike availability, which can turn into emergency response) and the amount of time you spend on it can go down over time.

For example, my retainers are typically maintenance and support contracts for mobile apps, either that I’ve built, or that my clients have brought to me to maintain. They pay me a monthly fee to never think about the app and to be assured that it’s working and staying up-to-date.

A huge advantage of these types of retainers is that you can really start to optimize your processes to spend less and less time accomplishing the same goal. This grows your profit margin, and is good for the client as well, as it typically means improving whatever you’re maintaining for them, and getting faster and more efficient. Win/win.

Bonus hint: for the purposes of thriving in a downturn, think hard about the items in the list above that would tend to make you a more and more vital part of the client’s organization.

How to price retainers

In terms of pricing your recurring revenue items, I like to keep it at a level where the income is significant to me, but not to where it’s so high that the client is going to feel a lot of pain paying for it every month. You want it to be on autopilot, and just a predictable expense that they don’t think too much about paying.

You also don’t want to be too dependent on any one client, so you’ll want at least 2-3 retainer clients, but there’s management overhead for each of these, so not too many.

For example, my sweet spot is earning $1000 – 3000 / month each from 3-5 different recurring revenue clients. That gives me $3k – 15k / month in recurring revenue, depending on the mix I have.

As I write this, I’m sitting at just under $9k in monthly recurring revenue from 3 different retainer clients. I spend a very reasonable amount of time each week fulfilling those engagements, and everyone is happy.

How to find opportunities for retainers in 15 mins:

- Open Basecamp, Trello, email, your notebook, or whatever you use to manage your projects.

- Look at the biggest 5 projects you’ve done over the last two years.

- For each, ask yourself this: What was the biggest pain point for the client before, during, and after the engagement?

- For each pain point, brainstorm a few ideas for retainers that would have helped. Pick one for each client.

- Email each of those 5 clients and ask them for feedback on your retainer options. You’re not selling them, just asking if they would have been interested.

An important note: I do not recommend building your freelance practice around a single long-term client, unless that client pays you 2-3x the market rate for your services, and at least twice what you need to make a comfortable living. Otherwise you risk a long, painful downturn after you part ways with that client, until you find the next one. If you’re making a huge margin on that client and you bank that money to cover the in-between time, you might be OK. I still think it’s preferable to have multiple clients. It’s too easy to have your mindset polluted by working for a single client for a long period of time.

5. Keep your chin up

When the bad times come, there will be a lot of ink spilled about how bad things are. You’ll probably see a lot of freelancers complaining about how it’s impossible to make a living at it anymore.

Don’t buy into any of it. Just ignore the whiners, haters, and naysayers.

No matter how bad things get, there will be tens of thousands of freelancers and consultants who will barely notice the recession. They’ll be too busy making money, because they were smart, prepared, and determined.

You can be one of them.

I want you to be one of them.

That’s why I’ve gone the extra mile and written down 5 more actionable steps you can take to recession-proof your freelance career.

I couldn’t put all of this information in this article without it being twice as long, so I’ve put it all into a VIP pack, which contains:

- A PDF of this guide so you can easily read it later, archive it, print it, share it, etc

- My guide to the lessons I learned from earning my first million dollars from client work

- An exclusive lifetime discount for LetsMakeApps.io, my premium automated lead generation tool to discover the best freelance gigs every day (this bonus alone is worth hundreds of dollars!)

- My email template pack, which includes the specific emails I’ve used to build my business to $250k+ in profit every year as a solo freelancer

- The complete guide to filling up your pipeline in an emergency (just in case you’re already in a downturn of your own!)

You can grab all of that goodness by downloading the free VIP pack right now:

I hope you feel better after reading this article. (I feel even better after writing it, and I felt pretty good before.)

I’m incredibly excited for the next ten years of my own freelance career, whatever comes my way. I hope you’ll join me in preparing for the peaks and the valleys by building strong, stable foundations for our businesses and achieve freelance success.

PS: Don’t forget to grab the free VIP pack!